Welcome!

Money matters plague Uncle Ambrose

Dear Nephew,

Your Uncle Ambrose is threatening to get off the internet and do business on a cash-only basis.

It’s kinda understandable since he’s had a couple of bad experiences related to the digital world. And they both involved money — his money.

One of the incidents started innocently enough — at least your uncle thought so. He got an email from Triple-A saying he’d won a safety kit for his car. He just had to fill out a survey and pay the shipping charge.

Your Uncle Ambrose, who normally doesn’t like to do surveys, decided that Triple-A is so trustworthy that he would go ahead. The questions asked, on a scale of 1 to 5, how likely he was to refer certain of the company’s programs to others.

Well, your uncle finished the survey and was asked to use his credit card to pay the nominal shipping charge. Afterward, he logged off and expected to receive his safety kit in 5 to 7 business days.

Within a day or so, the shipping charge from another company showed up on your uncle’s credit card account. Then, in another day or two he saw a charge for $76 from the same company.

That’s when your Uncle Ambrose called the credit card company and told a representative that he’d had an unauthorized charge on his card. The representative, one of those South Asians with the funny accent, assured your uncle that the $76 charge would be removed and that they would send him a new card to replace the now unsecured one. He told your uncle that there had been other calls about the same unauthorized charges.

Your Uncle Ambrose took the scissors to his old card and activated his new one.

That incident was pretty minor compared to one that he experienced several months ago.

As you may know, your uncle checks his bank account online every day, mainly to enter any withdrawals and deposits into his check register to keep his balance up to date. On this particular day, he noticed that his money market account was down nearly $10,000.

Your Uncle Ambrose called the bank to register a complaint and was told that his report would be investigated. Later, he got a call from a woman with the bank who asked him to sign a couple of documents. Then, an investigator called to grill him about his complaint.

Meanwhile, your uncle saw that another $5,000 had been withdrawn from the account. All the transactions were done by someone known as “Stephanie Ha.”

He reported those withdrawals to the bank and also called the local police to talk to a detective. The detective was able to get access to the bank account and started his investigation.

Apparently, what Stephanie Ha had done, after somehow getting your uncle’s market account number, was to make two deposits of less that a dollar. When those deposits went through, Steph then made the first two withdrawals. A few days later, she made two more withdrawals, virtually cleaning out the account.

When the bank completed its investigation, it returned all the money to your Uncle Ambrose’s account. In the meantime, the police detective traced the withdrawals to a Korean-American bank in California. As for who Stephanie Ha is, we’ll probably never find out.

“I’m about ready to cancel my credit and debit cards,” your uncle told me. “I may start carrying a wad of money around instead.”

“You don’t want to do that,” I said. “Somebody could see your roll of bills and decide he wants it enough to bash in your head.”

“Well, then I’ll go back to writing checks,” your uncle replied. “I haven’t written one of those in two or three years. Hey, can you use checks at self-checkouts?”

“I don’t know,” I said. “Why don’t you keep using your debit card? It’s a lot quicker.”

“Oh sure,” said your Uncle Ambrose. “Remember when somebody used my debit card number to spend $100 at a Pizza Hut in Cleveland, Ohio? Must have been some party.”

“Yeah, you had to have a new debit card after that,” I said.

“It’s a brave new world and I’m just getting older,” your uncle said.

Love,

Your Uncle Ambrose and Aunt Victoria

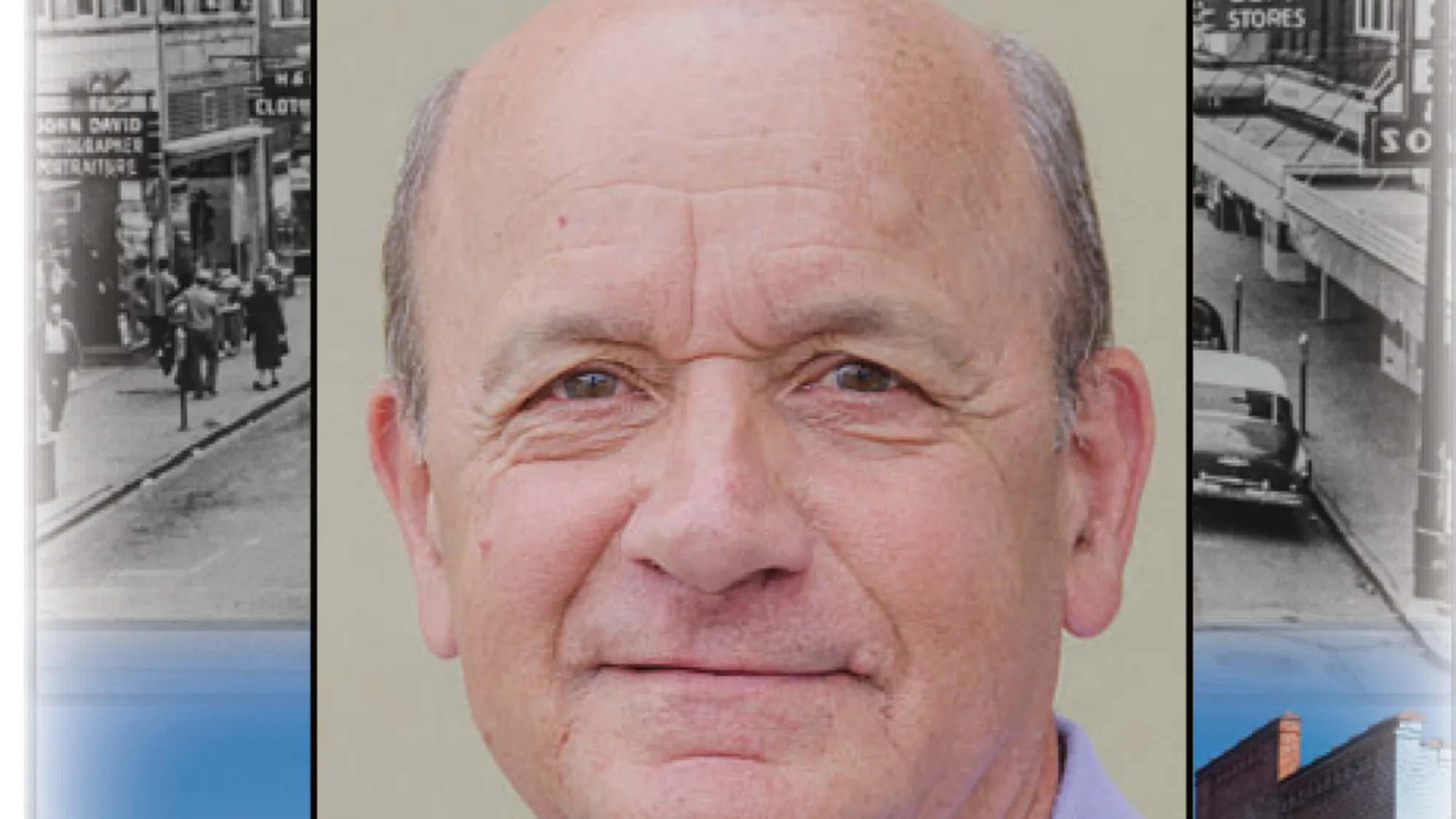

Larry Penkava is a writer for Randolph Hub. Contact: 336-302-2189, larrypenkava@gmail.com.